Manage your structured products,

more efficiently than ever.

The all-in-one platform to source, trade, and monitor all your structured products.

Book a demo

how it works

Transform your structured‑products workflow

LevineX offers you everything you need to elevate your structured products business.

Automated Trading Workflows

From indicative pricing to final settlement with zero manual overhead.

LevineX’s built‑in pricer delivers live quotes across all product types. One click launches fully automated RFQs to your preferred issuers or brokers, while our AI document parser instantly ingests new termsheets into your product library. Pre‑configured custodian and settlement connectors then carry trades through to reconciliation without a single spreadsheet handoff.

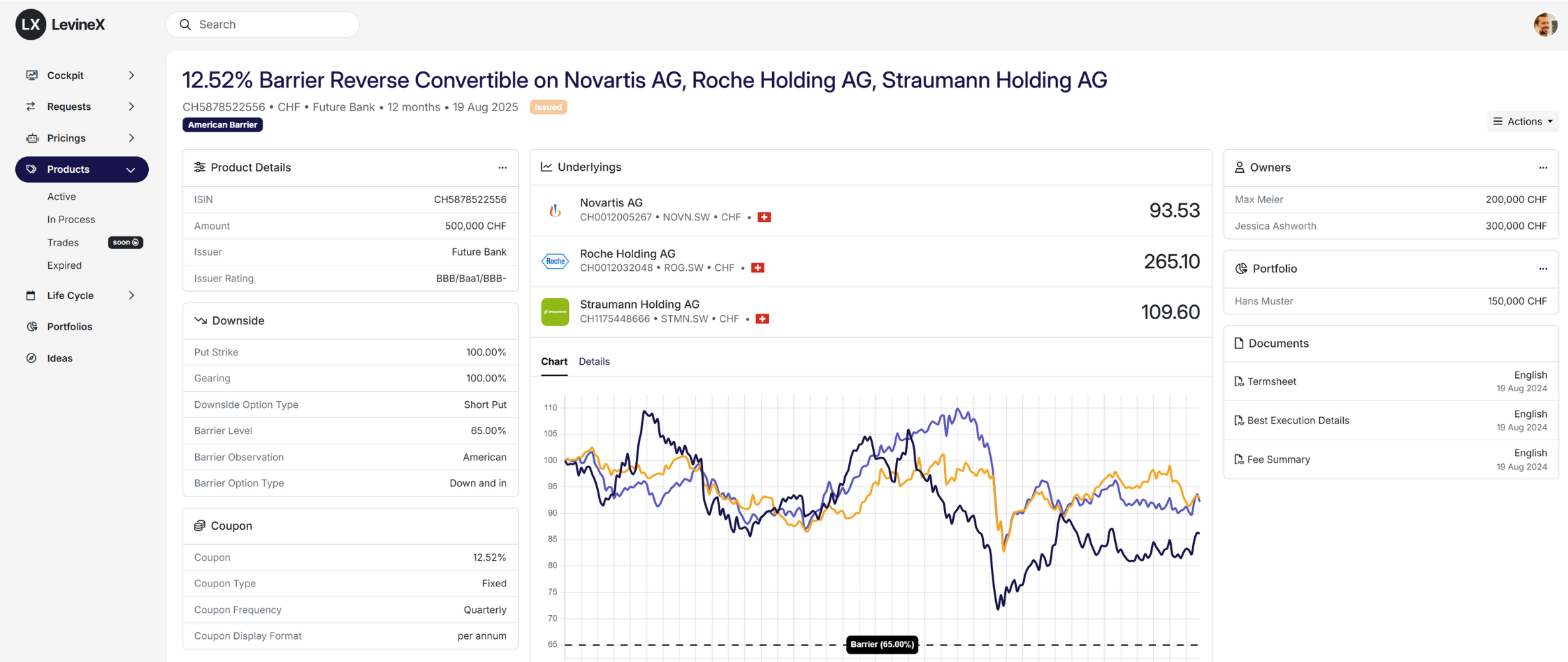

Holistic Life‑Cycle Management

Every barrier, early redemption, and payment—tracked and triggered.

Once a trade is done, LevineX takes over the journey: monitoring barrier knock‑ins, scheduling coupon fixings, and orchestrating final redemption. Custom alerts (email or in‑app) keep you and your clients in sync, and a complete, audit‑ready history of every lifecycle event lives in one central cockpit.

Embedded Relationship Ecosystem

Leverage your existing issuer, broker, and client network at scale.

Manage your full RFQ pipeline and deal negotiations within LevineX’s. No more toggling between systems. Route requests through your established counterparties, track every interaction, and grant clients access for real‑time exposure and performance updates. You maintain the personal touch, even as you grow.

“After switching to LevineX, we significantly improved the negotiated conditions of our structured products while simultaneously boosting our revenue base. With comprehensive lifecycle management, we now have full control over our active products.”

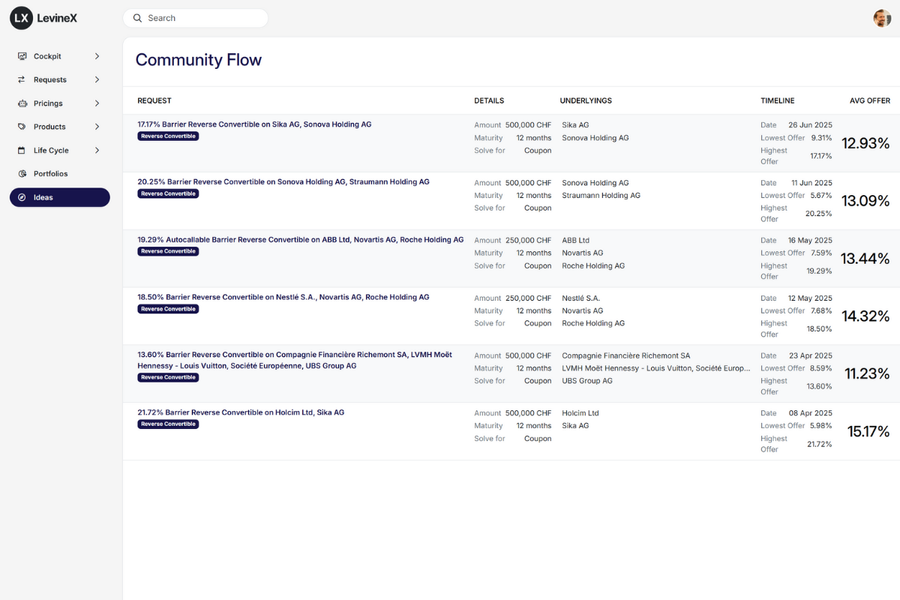

Idea Generation

LevineX helps you discover structured‑product ideas faster and more precisely. By analyzing real‑time market activity and leveraging our automated pricer, you can identify promising structures, check feasibility instantly, and prepare for execution. Soon, AI‑driven recommendations will personalize ideas to your book, and in future releases we’ll surface issuer‑sponsored concepts directly in your workflow.

-

Tap into a live feed of top‑traded products to spark new ideas

-

Run instant feasibility checks with our built‑in pricing engine

-

Preview indicative prices and sensitivities before you commit

-

Personalized recommendations via AI and collaborative filtering Coming Soon

-

Highlighted concepts promoted by your preferred issuers Future

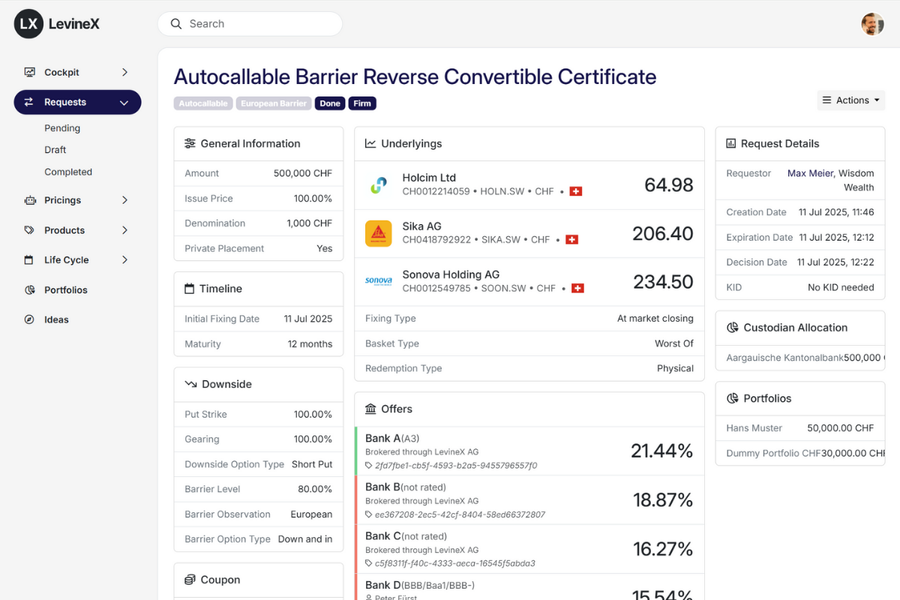

Trading

Streamline your execution with fully integrated trading tools. Whether you need lightning‑fast automated trades against issuer engines or personalized RFQs to your network, LevineX consolidates all workflows in one place. Eliminate emails, spreadsheets, and manual form‑filling by using our document parser, and let the platform manage settlement, best‑execution reporting, and reconciliation end‑to‑end.

-

Trade immediately against issuer trading engines

-

Send quotes directly to banks using your existing contacts or ours

-

Auto‑populate all trade details via the AI document parser

-

Settlement notifications, custodian integration, and reconciliations

-

Best‑execution reports and audit‑ready logs at your fingertips

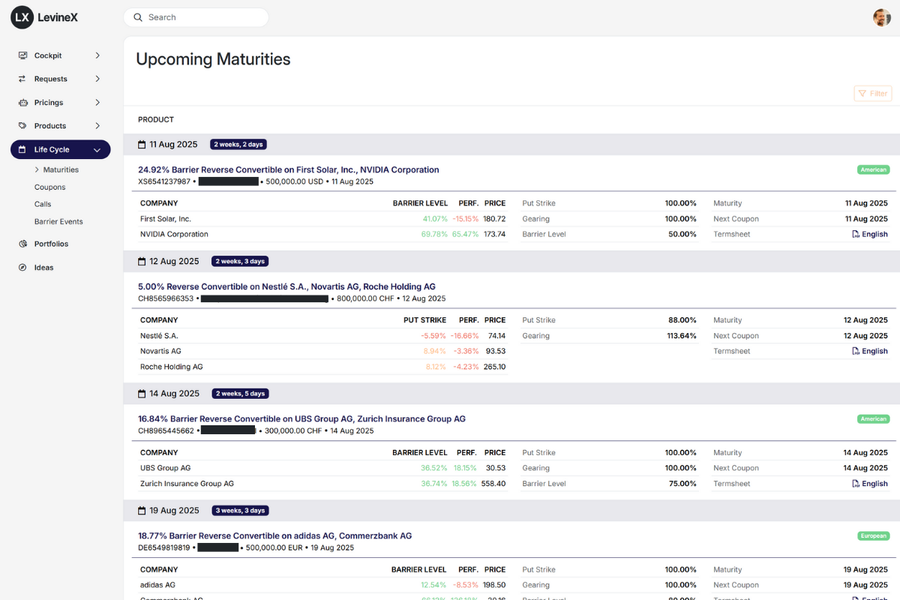

Life Cycle Management

After execution, LevineX takes charge of every lifecycle event so you never miss a beat. From barrier monitoring and coupon fixings to early redemption triggers and final maturities, the platform tracks and reports all critical milestones. Stay informed through real‑time alerts in the app or automated daily and weekly email summaries that keep you and your clients aligned at every stage.

-

Automated barrier‑breach and knock‑in/knock‑out checks

-

Scheduled coupon fixing reminders and payment tracking

-

Early redemption and maturity event notifications

-

Consolidated audit trail of every lifecycle action

-

Customizable email digests (daily and weekly) for ongoing transparency